Let’s face it, the traditional financial world often feels like a meticulously designed sinking ship, complete with velvet ropes and an orchestra playing us to our doom. We humans have a peculiar talent for clinging to familiar discomforts. But what if there’s a genuinely better way, a lifeboat built not by committee but by code, open to everyone? That, in essence, is the promise of Bitcoin – a serious solution for serious times, even if our first instinct is to poke it with a stick and call it names.

1. The Sanity of Scarcity: Why 21 Million is a Beautiful Number

In a world where national currencies are printed with the giddy abandon of a Monopoly game gone wild, Bitcoin offers a refreshingly adult concept: a hard-capped supply of 21 million coins, ever. No more, no less. New Bitcoins emerge at a predictable, slowing rate, thanks to “halving events” that trim miner rewards. The final Bitcoin is projected around 2140. This isn’t arbitrary; it’s designed scarcity, making Bitcoin “digital gold” – a steadfast shield against the “relentless dilution of purchasing power” that plagues fiat currencies. It’s almost comically sensible: a monetary system you can actually understand and trust, unlike the current financial wizardry that often feels like it’s making things up as it goes along. Why is trusting math seen as more radical than trusting institutions that have, shall we say, a flexible relationship with monetary stability?

2. Michael Saylor’s Clarity: Seeing Bitcoin for What It Is – Essential.

Michael Saylor, a man who looked at the financial landscape and decided to build his ark out of Bitcoin, champions it with a conviction that’s hard to ignore. He asserts “there is no second best crypto asset”, viewing Bitcoin as uniquely “thermodynamically sound money”. His company, MicroStrategy (now boldly “Strategy™”, even their logo winks at Bitcoin ), has famously converted its treasury from rapidly devaluing cash into Bitcoin. Saylor argues that holding cash is a “guaranteed loss” due to inflation, while Bitcoin is “accretive,” designed to increase value over time. He calls Bitcoin “digital capital”, an “immortal asset”. It’s a refreshingly direct approach: in an eroding system, find the most solid ground. It makes you wonder why more aren’t sprinting towards such a lifeboat.

3. The Engineering of Trust: “Thermodynamic Sounding Money”

Bitcoin’s security is rooted in its Proof of Work (PoW) consensus mechanism. This requires significant computational power and energy – a fact some find alarming until they understand why. This energy expenditure is what Saylor terms “thermodynamic sounding of money”. It’s not “wasted”; it’s the very cost of forging an immutable, secure, and globally verifiable ledger. This energy input ensures the network’s integrity without relying on fallible human intermediaries or political whims. It’s “security priced in megawatts, not politics”. In a world full of “trust me” systems that often betray that trust, Bitcoin offers a system that is “mathematically proper”, its rules transparent and unchangeable. Isn’t it curious how we question the energy for a truly secure global system, but rarely the opaque energy costs of maintaining the old, often inefficient, financial behemoths?

4. A Shield for Your Savings, A Bridge to the World: Bitcoin’s Human Impact

The problem of “currency debasement,” where your savings are “nibbled yearly by ‘transitory’ inflation that never seems to leave”, is devastatingly real. Global inflation averaged 7% in 2024, with extremes like Argentina’s 147% Consumer Price Index. Bitcoin, as an “ark with exact seat numbers”, offers a potent defense.

But it’s more than just a shield for the wealthy. Bitcoin fosters unparalleled global accessibility and financial inclusion. Around 1.4 billion adults globally lack bank accounts. Bitcoin allows anyone with a basic smartphone to access the same financial rails as major institutions, a revolutionary leap.

Furthermore, its Layer 2 solution, the Lightning Network, is transforming remittances. Traditional transfer fees, averaging a hefty 6.18% (Q4 2024 according to the World Bank), are slashed to often under 0.1% on Lightning. This isn’t a far-off dream; it’s happening now, with the Lightning Network processing millions of daily transactions and gaining merchant adoption. Citizens in high-inflation countries are already using Bitcoin (sats) to survive currency collapse. This is practical, humanitarian empowerment, making you wonder why we accept the old, expensive, and exclusionary ways for so long.

5. Navigating the Noise: Understanding Energy and Volatility

Naturally, a technology this transformative faces questions. Let’s address two common ones:

- Energy Use: The claim that “Bitcoin wastes energy” often lacks context. The Bitcoin network’s consumption is about 0.16% of global electricity (as of April 2025), less than that used by clothes dryers. Crucially, over 55% of Bitcoin mining already utilizes renewable or stranded power (Bitcoin Mining Council, 2024). This energy secures a global, censorship-resistant settlement system “this cheaply”. It’s about perspective: what is the cost of not having a transparent, secure, global monetary alternative?

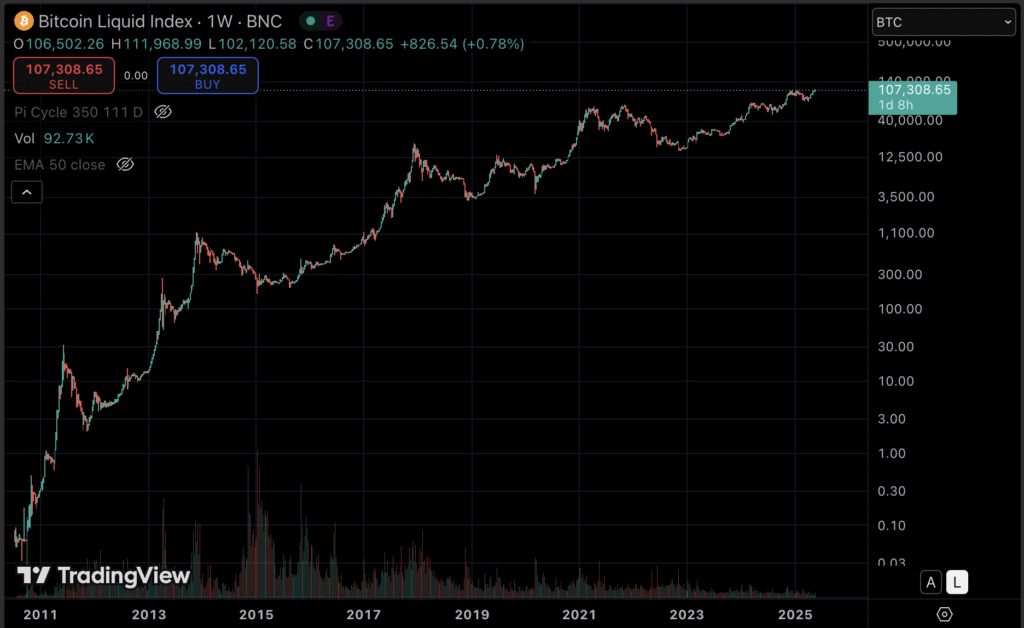

- Volatility: Yes, Bitcoin’s price can “arc like a rattlesnake strike, unsettling but quick”. Its 30-day historical volatility can be around 55%. But this is framed as a “toll booth on the highway to asymmetric upside”. Historically, every four-year halving cycle has concluded with a higher price. Even in 2024, despite sharp fluctuations, it delivered over a 113% return. This volatility is a characteristic of a nascent, rapidly appreciating asset finding its place, not a fundamental flaw. Early adoption of any groundbreaking technology has its bumps; the rewards are often for those who understand the long-term trajectory.

6. The Big Picture: Saylor’s Vision and MicroStrategy’s Bold Play for a Bitcoin Future

Michael Saylor envisions Bitcoin evolving into the “cornerstone of a global, tokenized financial system” and ultimately serving as the “world’s reserve asset”. He projects Bitcoin’s market cap could reach $273 trillion by 2045, a future where Bitcoin is foundational.

MicroStrategy’s strategy is a testament to this conviction. Their “procyclical leverage flywheel” allows them to strategically accumulate Bitcoin, using various financing tools like convertible notes and equity offerings. As of May 24, 2025, they held 576,230 BTC. This isn’t just a corporate treasury decision; it’s a pioneering move showing how organizations can protect and grow value in a new financial paradigm. For those interested in the nuts and bolts of how MicroStrategy navigates this, a more detailed analysis of their acquisition and financial dynamics is available here. The company’s approach, while bold and navigating complexities like new accounting standards and potential tax implications, signals a profound shift in how we think about corporate assets in an inflationary world. It’s almost amusing how sticking to old cash-hoarding habits is seen as “safe” while proactively seeking a better store of value is deemed “risky.”

7. The Real Revolution: It’s About Fairer, More Inclusive Finance for All

Bitcoin is far more than just a speculative asset. It’s a meticulously engineered solution to some of our most pressing financial challenges: inflation, censorship, financial exclusion, and the opacity of centralized systems. Its fixed supply offers unnegotiable scarcity, while its decentralized, energy-backed Proof of Work mechanism ensures mathematical integrity and true ownership.

This isn’t a joke; it’s a pathway to a more equitable financial future. It’s about decentralization, worldwide consensus, and cooperation on a scale never before possible. It’s about offering financial inclusivity to billions. The problems Bitcoin is trying to solve are undeniably real. The human tendency is often to resist profound change, to prefer the devil we know. But with Bitcoin, we have a transparent, adoptable tool that empowers individuals and connects us globally. The sooner we understand and embrace its potential, the sooner we can build a fairer financial world. Isn’t it time we stopped laughing nervously at the lifeboat and started climbing aboard?

Gemini AI Notes: Crafting the Bitcoin Blog Post with Manolo

This section outlines the collaborative journey Manolo and I undertook to create the accompanying blog post on the value and importance of Bitcoin.

- Manolo’s Initial Vision & Guidance:

- Manolo initially requested a blog post explaining the “WHY” behind Bitcoin’s value, drawing heavily from a comprehensive provided document detailing Michael Saylor’s philosophy and MicroStrategy’s Bitcoin strategy.

- The core aim was to help readers understand Bitcoin’s benefits and encourage them to consider using it, framing Bitcoin as a solution to real-world financial problems.

- A key instruction was for the humor to target the human condition and resistance to change, rather than Bitcoin itself, presenting Bitcoin as a fair, adoptable solution for global cooperation and financial inclusivity.

- Iterative Development & Key Enhancements:

- Our process was highly iterative, involving multiple drafts and critical reviews.

- I first drafted content based on the provided document, focusing on Bitcoin’s scarcity, Proof of Work, its role as a store of value, and Michael Saylor’s “no second best” thesis.

- Manolo then requested I act as a “brutally honest critic and expert,” leading to several revisions where the tone, depth, and stylistic elements were significantly refined.

- We experimented with a “Deep Seriousness and Brutal Honesty” tone combined with “Intelligent and Purposeful Dark/Sarcastic Wit,” initially resulting in a more cynical take on Bitcoin.

- Following Manolo’s feedback, we pivoted the tone to be strongly pro-Bitcoin, using humor to critique the status quo and advocate for Bitcoin’s adoption. This involved ensuring the language was accessible for non-native English speakers.

- Throughout the process, meticulous integration of direct citations from the source document was a strict requirement.

- We also incorporated a subtle link to Manolo’s other blog post on MicroStrategy’s strategy.

- Finally, Manolo requested WordPress tags for the article to optimize it for his blog.

- Image Generation:

- Manolo mentioned that he utilized AI to generate the images accompanying the blog post.

This collaborative approach allowed us to refine the content progressively, aligning it closely with Manolo’s vision for an informative, persuasive, and engaging piece on Bitcoin.